expense tracker pdf

Expense Tracker PDFs⁚ A Comprehensive Guide

Expense tracker PDFs are a valuable tool for individuals and businesses looking to gain control over their finances. These printable documents offer a structured way to track spending, analyze expenditures, and make informed financial decisions. This comprehensive guide will explore the benefits, types, features, and effective usage of expense tracker PDFs.

Introduction

In today’s world of digital payments and online shopping, it’s easy to lose track of where your money is going. Expense tracking has become an essential aspect of personal and business financial management. While various methods exist, expense tracker PDFs offer a simple yet effective solution. These printable documents provide a structured framework for recording and monitoring your spending habits, empowering you to gain insights into your financial behavior and make informed decisions. Expense tracker PDFs are a versatile tool that can be tailored to suit individual needs and preferences, whether you’re striving to achieve personal financial goals or managing business expenses.

Benefits of Using an Expense Tracker PDF

Utilizing an expense tracker PDF offers numerous benefits for individuals and businesses alike. Firstly, it provides a clear and organized record of your spending, enabling you to identify areas where you may be overspending and adjust your habits accordingly. This detailed record empowers you to make informed financial decisions and achieve your savings goals more effectively. Secondly, expense tracker PDFs are highly customizable, allowing you to tailor them to your specific needs and preferences. You can choose from a variety of templates, add categories relevant to your spending habits, and even personalize the design to make the tracking process more engaging. Moreover, expense tracker PDFs are accessible and convenient. They can be printed and used anywhere, eliminating the need for internet access or specific software. This portability makes them ideal for individuals who prefer a hands-on approach to financial management.

Types of Expense Tracker PDFs

Expense tracker PDFs come in a variety of formats, catering to different needs and preferences. Monthly expense tracker PDFs offer a comprehensive overview of your spending over a 30-day period, allowing you to analyze your financial habits on a larger scale. Weekly expense tracker PDFs provide a more granular view of your spending, enabling you to track your daily or weekly expenses and identify potential areas for improvement. Daily expense tracker PDFs are ideal for individuals who prefer a detailed record of their spending, allowing them to monitor their financial activity on a day-to-day basis. Business expense tracker PDFs are specifically designed for businesses to track expenses related to operations, travel, marketing, and other business-related activities. These PDFs often include features for categorizing expenses by department or project, making it easier to analyze and manage business finances.

Monthly Expense Tracker PDFs

Monthly expense tracker PDFs are a popular choice for individuals seeking a comprehensive overview of their spending habits. These templates typically include sections for recording income, expenses, and savings goals. They often feature columns for categorizing expenses into different categories, such as housing, food, transportation, and entertainment. This allows you to gain insights into where your money is going and identify areas where you might be able to reduce spending. Monthly expense tracker PDFs are also beneficial for budgeting purposes, as they provide a clear picture of your income and expenses over an extended period, enabling you to create a realistic budget and track your progress towards your financial goals.

Weekly Expense Tracker PDFs

Weekly expense tracker PDFs provide a more granular view of your spending habits than monthly trackers. These templates allow you to record your expenses on a daily or weekly basis, offering a detailed breakdown of your spending patterns. This level of detail can be particularly helpful for identifying impulsive purchases or areas where you might be overspending. Weekly trackers can also be useful for tracking progress towards short-term financial goals, such as saving for a vacation or paying off a small debt. Their concise format makes it easier to monitor your spending on a regular basis and make adjustments as needed.

Daily Expense Tracker PDFs

Daily expense tracker PDFs offer the most detailed level of tracking, allowing you to meticulously record every expenditure throughout your day. This level of granularity can be particularly helpful for individuals who want to gain a deep understanding of their spending habits and identify areas where they can save money. Daily trackers are especially beneficial for individuals who are trying to stick to a strict budget or manage their finances closely. By recording every transaction, you can quickly identify any deviations from your plan and make adjustments as needed. While daily tracking may seem time-consuming, it can provide valuable insights into your spending patterns and empower you to make more informed financial decisions.

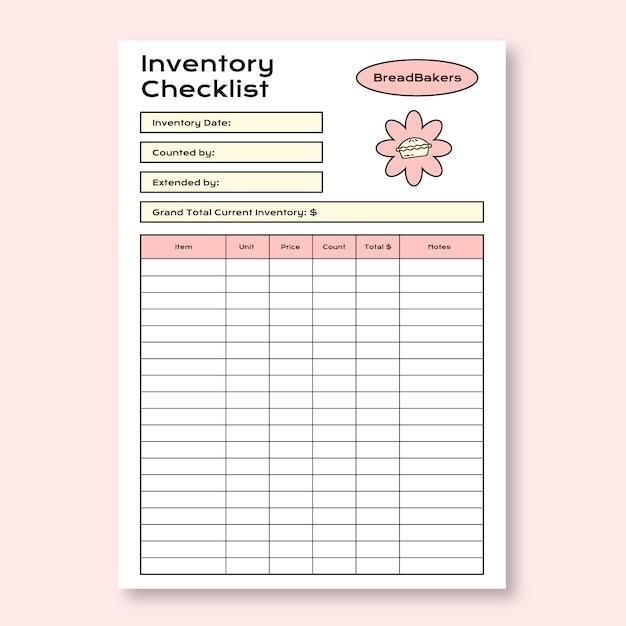

Business Expense Tracker PDFs

Business expense tracker PDFs are essential for small businesses and freelancers to manage their finances effectively. These templates are designed to track various expenses related to business operations, such as travel, marketing, supplies, and salaries. By using a business expense tracker PDF, you can easily categorize and track expenses, ensuring accurate record-keeping for tax purposes and financial reporting. These trackers provide a comprehensive overview of business spending, enabling you to analyze profitability, identify areas for cost reduction, and make informed financial decisions. Whether you are a sole proprietor or a small business owner, a business expense tracker PDF can streamline your accounting processes and provide valuable insights into your company’s financial performance.

Key Features of Expense Tracker PDFs

Expense tracker PDFs incorporate several key features that enhance their effectiveness in managing personal and business finances. Categorization of expenses allows users to track spending across different categories, providing a clear picture of where money is going. Date tracking is essential for recording the date of each transaction, enabling users to analyze spending patterns over time. Budgeting and goal setting features allow users to set financial goals and track progress towards achieving them. These features can help users identify areas where they are overspending and make adjustments to their spending habits. Visualization and reporting features often include charts and graphs that provide a visual representation of expenses, making it easier to identify trends and make informed financial decisions.

Categorization of Expenses

Categorization of expenses is a fundamental feature of expense tracker PDFs, playing a crucial role in providing a clear and insightful view of spending patterns. By dividing expenses into different categories, such as housing, transportation, food, entertainment, and others, users gain a comprehensive understanding of where their money is going. This feature enables users to identify areas where they are overspending and make adjustments to their budget accordingly. For example, if a user realizes that they are spending a significant portion of their income on dining out, they can adjust their budget to allocate more money towards savings or other essential expenses. Categorization provides a structured framework for analyzing expenses and making informed financial decisions.

Date Tracking

Accurate date tracking is essential for effective expense management. Expense tracker PDFs often incorporate dedicated columns or fields for recording the date of each transaction. This feature allows users to pinpoint the exact time of each expenditure, enabling them to analyze spending patterns over specific periods, such as weeks, months, or even years. For instance, a user might notice a spike in spending during the holiday season or identify recurring expenses that occur on a monthly basis. By tracking dates, users can identify trends, understand their spending habits, and make informed adjustments to their financial plans. Date tracking provides a historical record of expenses, facilitating a deeper understanding of spending behaviors and patterns over time.

Budgeting and Goal Setting

Expense tracker PDFs empower users to establish budgets and set financial goals; By tracking spending patterns, users can identify areas where they can cut back or allocate funds more effectively. These documents often include sections for setting monthly or annual budget limits, allowing users to compare actual spending against their targets. This comparison reveals whether they are on track or need to make adjustments. Furthermore, expense tracker PDFs can facilitate goal setting; Users can define specific financial aspirations, such as saving for a down payment on a house or paying off debt. By monitoring progress against these goals, users can stay motivated and make informed decisions to achieve their financial objectives. The combination of budgeting and goal setting features in expense tracker PDFs provides a powerful tool for achieving financial stability and reaching personal financial goals.

Visualization and Reporting

Expense tracker PDFs often incorporate features that enhance visualization and reporting, providing users with a clearer understanding of their spending patterns. Visual representations, such as charts and graphs, can illustrate how money is being allocated across different categories. These visualizations can reveal spending trends, identify areas of overspending, and highlight potential savings opportunities. Some PDFs include summary sections that provide a concise overview of total expenses, income, and net savings for a specific period. This summary information facilitates quick analysis and helps users identify areas for improvement. The ability to generate reports based on tracked data empowers users to make informed financial decisions. They can analyze past spending habits, project future expenses, and adjust their budgeting strategies accordingly. Visualization and reporting features in expense tracker PDFs transform raw data into actionable insights, making it easier for users to manage their finances effectively.

Finding and Using Expense Tracker PDFs

Expense tracker PDFs are readily available online, offering a range of options to suit diverse needs and preferences. Many websites provide free printable expense tracker PDFs, allowing users to download and start tracking their spending immediately. These free templates often include basic features such as categories, dates, and amounts, making them suitable for individuals seeking a simple and straightforward approach to expense tracking. For those who require more advanced features or customization, paid expense tracker PDFs are available. These paid options may offer additional functionalities such as budgeting tools, goal setting features, and integrated reporting capabilities. Moreover, customizable expense tracker PDFs allow users to tailor the template to their specific requirements. They can add or remove categories, adjust the layout, and personalize the design to match their preferences. Finding and using expense tracker PDFs is a convenient and accessible way to gain control over personal or business finances.

Free Printable Expense Tracker PDFs

Free printable expense tracker PDFs are readily available online, offering a convenient and budget-friendly option for individuals seeking to manage their finances. Websites such as Pinterest, Shining Mom, and 101 Planners provide a variety of free printable expense tracker templates that can be downloaded and printed. These templates often include basic features such as categories, dates, and amounts, making them suitable for individuals seeking a simple and straightforward approach to expense tracking. The free templates are particularly beneficial for individuals who are new to expense tracking or prefer a minimalist approach. They allow users to experiment with expense tracking without any financial commitment. Additionally, free printable expense tracker PDFs are a great option for individuals who prefer a tangible and visual method of tracking their spending. The act of writing down expenses can be a more mindful and engaging process compared to using digital tools.

Paid Expense Tracker PDFs

For those seeking more advanced features and customization options, paid expense tracker PDFs offer a range of benefits. These PDFs are often available for purchase from online platforms or specialized financial websites. They typically provide more detailed templates with additional features like budgeting sections, income tracking, and personalized goal setting. Some paid expense tracker PDFs may also offer interactive elements, such as clickable links, drop-down menus, and data visualization tools. These features can enhance the user experience and make expense tracking more engaging and efficient. Furthermore, paid expense tracker PDFs may include professional design and formatting, making them visually appealing and easy to use. The investment in a paid expense tracker PDF can be justified for individuals who prioritize a user-friendly and comprehensive solution for managing their finances.

Customizable Expense Tracker PDFs

Customizable expense tracker PDFs offer the ultimate flexibility in managing your finances. These PDFs allow you to tailor the template to your specific needs and preferences. You can adjust categories, add custom fields, and modify the layout to suit your budgeting style. Some customizable expense tracker PDFs may be available for purchase, while others can be found for free online. These PDFs are often offered in formats that can be easily edited using software like Adobe Acrobat or Microsoft Word. The ability to personalize your expense tracker PDF ensures that you have a tool that aligns perfectly with your financial goals and habits. With customizable expense tracker PDFs, you have the power to create a system that is both efficient and effective in helping you track your spending and achieve your financial objectives.

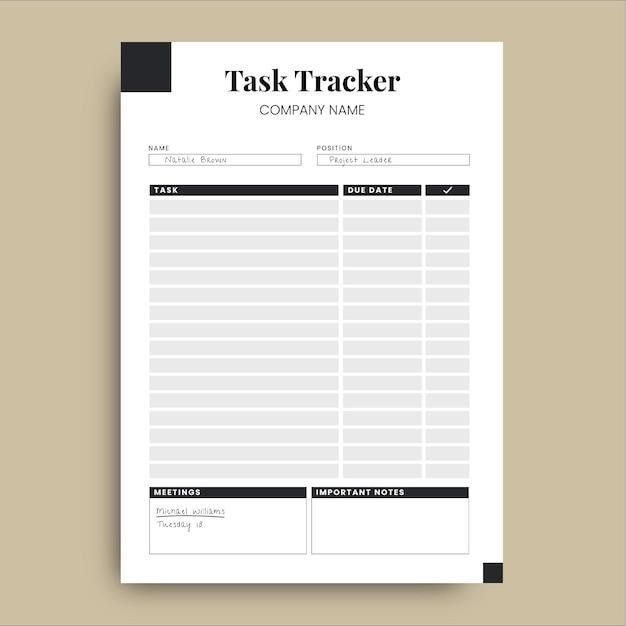

Tips for Effective Expense Tracking with PDFs

Maximizing the effectiveness of expense tracker PDFs requires a strategic approach. Consistency is key – make it a habit to update your PDF regularly, whether it’s daily, weekly, or monthly. This ensures accurate data and allows you to identify spending patterns over time. Regularly analyze the data in your expense tracker PDF to gain valuable insights into your spending habits. Identify areas where you can cut back, prioritize savings goals, and make adjustments to your budget based on your financial objectives. Consider integrating your expense tracker PDF with other financial tools, such as online banking apps or budgeting software. This can streamline your financial management and provide a more comprehensive view of your overall financial picture;

Consistency and Regular Updates

The foundation of effective expense tracking with PDFs lies in consistency and regular updates. Make it a non-negotiable habit to record your expenses in your PDF tracker as often as possible, whether it’s daily, weekly, or monthly. This discipline ensures the accuracy of your financial data and allows you to identify trends and patterns in your spending over time. Regular updates also prevent the accumulation of forgotten expenses, which can skew your financial picture and make it challenging to make informed decisions. Consistency in updating your expense tracker PDF is crucial for gaining a clear understanding of your financial situation and making informed decisions about your spending habits.

Data Analysis and Insights

The power of expense tracker PDFs extends beyond mere record-keeping; they serve as valuable tools for data analysis and gaining crucial financial insights. Once you’ve diligently tracked your expenses over a period of time, you can leverage the data to identify areas where you may be overspending, uncover recurring expenses that could be optimized, and assess the effectiveness of your budgeting strategies. The insights gleaned from this analysis empower you to make informed decisions about your financial priorities, adjust your spending habits accordingly, and ultimately achieve your financial goals. Expense tracker PDFs offer a tangible way to visualize your financial patterns and gain valuable insights that can lead to positive changes in your spending habits.